Reverse Mortgage Las Vegas

If you’re an older homeowner, a reverse mortgage may be a great way to earn some extra cash. Reverse mortgages in Las Vegas are available to homeowners age 62 or older. They allow homeowners to convert home equity into cash without incurring additional bills or having to move out of the home. In turn, homeowners can supplement their income, pay off an existing mortgage, pay for healthcare expenses, and more. If you are considering a reverse mortgage, see our blog How to Know If a Reverse Mortgage is Right for You. Feel free to also contact a loan officer in Las Vegas with questions about next steps.

What is a Reverse Mortgage?

What is a Reverse Mortgage?

A reverse mortgage is a loan arrangement where the lender pays you. With a regular mortgage, you work your way towards homeownership by paying the lender a small amount of money each month. Eventually, you pay off the loan and own your home. Reverse mortgages in Las Vegas, however, involve turning some equity in your home into cash. Each month, interest is added to the loan balance, which grows over time. The loan does not have to be paid off while you’re still living in the home. Instead, the loan will be repaid when the last borrower, eligible spouse, or co-borrower sells the home, moves, or passes away.

Types of Reverse Mortgages

There are three types of reverse mortgages, which are:

- Single-purpose reverse mortgages

- Proprietary reverse mortgages

- Home Equity Conversion Mortgages (HECMs)

State and local government agencies typically offer Single-purpose reverse mortgages. They are sometimes available through non-profit organizations, too. Single-purpose reverse mortgages are local, which means they’re not available everywhere. As the name implies, a single-purpose reverse mortgage can be used for just one purpose, which is specified by the lender. This may include property taxes, home improvements, or home repairs.

A proprietary reverse mortgage is a private loan. Proprietary reverse mortgages are private loans backed by non-governmental entities. Proprietary reverse mortgages are ideal for homes with a higher value, as homeowners can typically get a bigger loan advance. If you have a small mortgage and your home has a higher appraised value, you may qualify for more funding.

HECMs are reverse mortgages that are backed by the federal government. Unlike other types of reverse mortgages, HECMs can be used for a wide variety of purposes. Although these loans are versatile, they can be more expensive than conventional home loans. If you’re not planning to stay in your house for a long time, a HECM may not be the best option. Additionally, the amount of money that you can borrow with a HECM is dependent on several factors including your age, your home’s appraised value, interest rates, the type of reverse mortgage you choose, and your ability to pay for expenses associated with owning a home such as property taxes and homeowner’s insurance. (Read about finding the right home mortgage for you.)

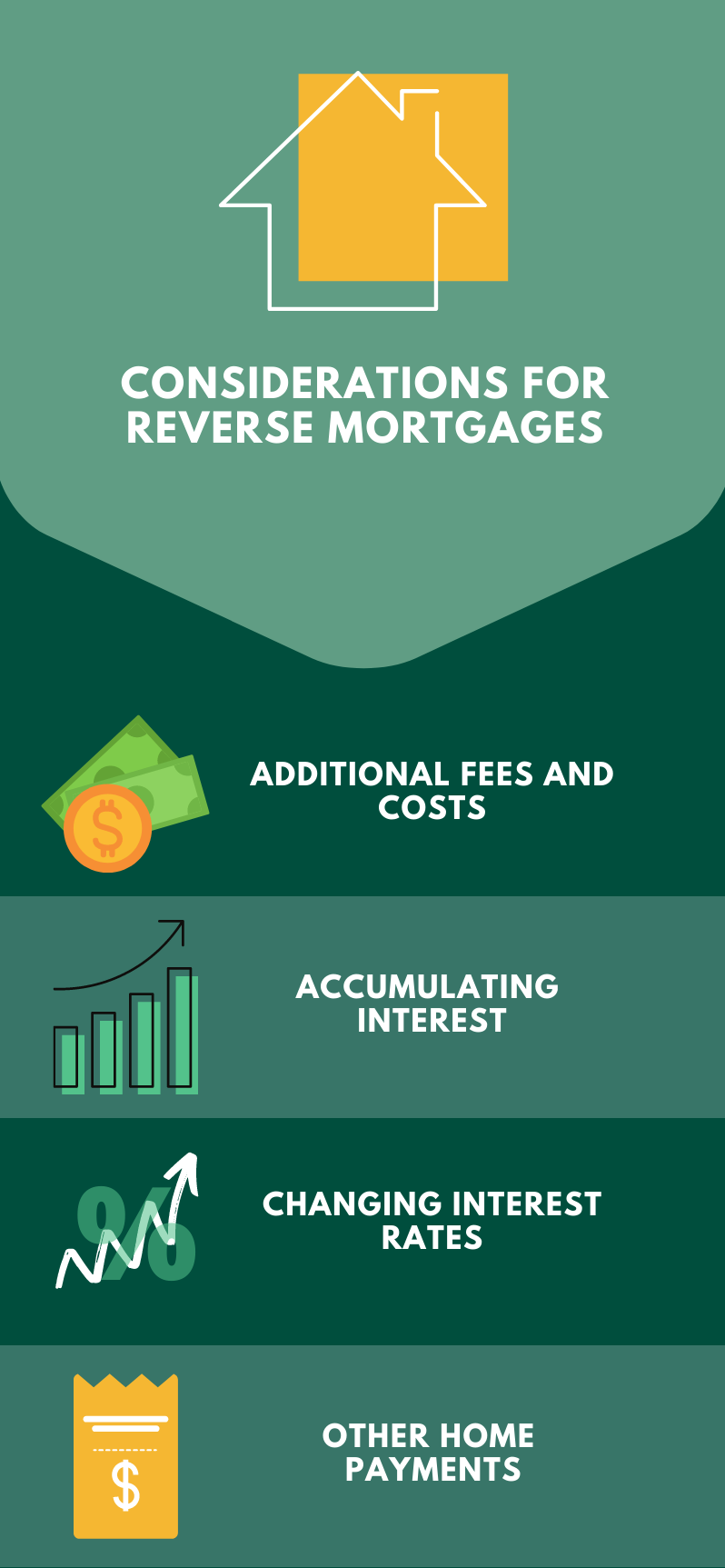

Considerations for Reverse Mortgages

Considerations for Reverse Mortgages

If you think a reverse mortgage sounds appealing, the next step is to contact a mortgage company Las Vegas for more information. A mortgage company can provide additional details about what to consider before you get a reverse mortgage, such as:

- Additional fees and costs

- Accumulating interest

- Changing interest rates

- Other home payments

Most reverse mortgage lenders charge additional fees for their services if you take out a reverse mortgage through them. This includes an origination fee, servicing fees over the mortgage’s lifetime, and closing costs. Additionally, some lenders will also charge mortgage insurance premiums, especially for HECMs.

Over time, interest is added to the balance of your mortgage. Even though you don’t have to pay the loan right away, the amount that you ultimately owe grows over time. Another consideration is that interest rates for a reverse mortgage are variable. Most are connected to a financial index and subject to change based on market conditions. This variability provides more options for homeowners on how to get their money through a reverse mortgage. You can also find reverse mortgages, namely HECMs, that offer fixed interest rates. However, choosing this option means that you will typically take the loan as a lump sum at the end.

Furthermore, the amount that you can borrow is often less than what you would be able to get with a variable rate loan. Keep in mind that interest on reverse mortgages is not usually deductible on income tax returns until the loan is paid off. While you get to keep the title to your home with a reverse mortgage, you are generally responsible for other costs associated with your home, such as utilities, property taxes, and insurance.

How a Mortgage Lender Could Help

A mortgage lender performs a financial assessment that includes looking at your payment history, credit, and checking for outstanding mortgage loans. A lender will also verify that you don’t have any federal debts or property liens. The lender will request to see income statements such as Social Security, pension payments, a 401(k), or pay stubs to verify that you can cover all housing costs.

Depending on your goals, a reverse mortgage can be a great way to earn extra cash from your home equity. However, there’s a lot to consider when deciding on a reverse mortgage. A loan officer in Las Vegas can explain the advantages of a reverse mortgage and help you choose the right one for you.

Call the Drennen team! We are dedicated to providing an AMAZING EXPERIENCE for YOU every day. Contact us with any questions about reverse mortgages in Las Vegas.

Updated 1/15/21