Home Renovation Loan

You should consider a renovation loan if the project will add to the home’s value, safety, or lower living costs. At the same time, you own the home, such as upgrading a bathroom to have more energy-efficient appliances. Some people also renovate their homes before selling them to make them more attractive to buyers.

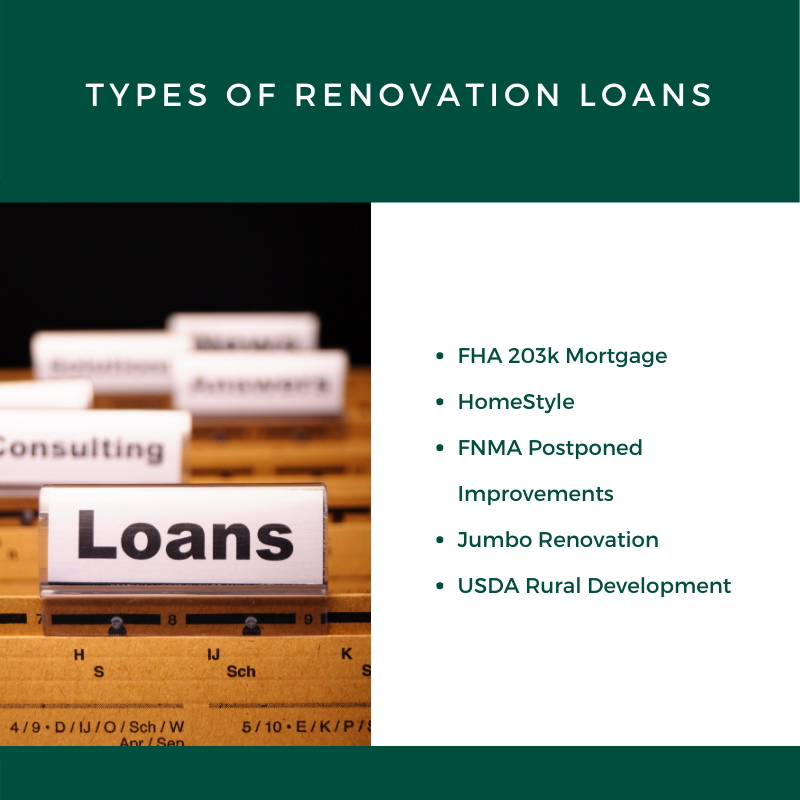

Types of Renovation Loans

- FHA 203k Mortgage

- HomeStyle

- FNMA Postponed Improvements

- Jumbo Renovation

- USDA Rural Development

An FHA 203k loan is a loan backed by the government. It’s similar to the HomeStyle loan administered by Fannie Mae, but it is available to homeowners who have a lower credit score. It is typically a slightly more expensive loan than traditional renovation mortgage loans Las Vegas because it also tacks a higher mortgage insurance premium. However, it is available to homeowners for a smaller down payment. A 203k loan is available for primary residences. It has a loan limit of $35,000.

Homestyle Renovation Loan

Fannie Mae administers the HomeStyle loan. One advantage of the HomeStyle loan is that it allows borrowers to receive a generous loan amount to fix their existing homes by making repairs and renovations. HomeStyle loans are also available for vacation homes and investment properties in addition to primary residences. If you’re planning to take out a HomeStyle loan, however, be aware that lenders usually impose restrictions on the amount that can be borrowed for a non-primary home and permissible uses for the funding. (Read more on the Las Vegas housing market here.)

The FNMA Postponed Improvements Programs is a loan program that can also be used for primary residences and second homes. An FNMA loan is a conventional renovation loan Las Vegas available with a five percent down payment. It can be used for just about any kind of home improvement project that you want to complete for your home, provided it adds value to the property. Additionally, the cost of the renovation cannot exceed 15 percent of the home’s value.

A Jumbo Renovation loan Las Vegas can be used for higher-priced homes that may not qualify for other home loans. Jumbo Renovation loans are suitable for projects that the homeowner wants to make or that an appraiser recommends. Renovations completed through the Jumbo Renovation program must be non-structural. They must also add to the home’s overall value.

USDA Rural Development loans are loans designed to enable renovations for homes in rural areas. USDA loans are designed to provide homeowners with safe and structurally sound housing. USDA funding can be used for several home improvement projects, such as upgrading or repairing the windows, plumbing, electrical system, siding, roofing, and foundation. You can also use USDA loans for new appliances. USDA loans are available to homeowners who have homes in designated USDA zones and whose income qualifies for federal loan assistance.

There are many advantages to taking out a renovation loan for your home, including the opportunity to improve your home without putting much money down. Home renovation loans are also a great way to get more financing for your home improvement project than other types of loans. To learn more about the benefits of home improvement loans and find the type of loan that works best for your needs and budget, contact our office for expert assistance today.