What Determines Monthly Mortgage Payments

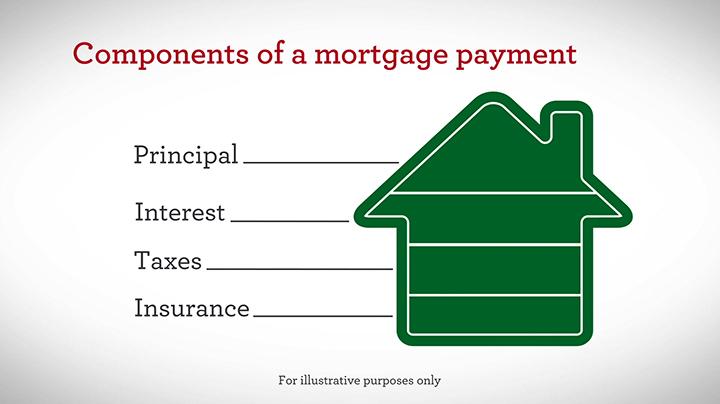

When you’re getting ready to purchase a home, it’s likely that you don’t have enough cash to buy the property outright. As such, you’ll need to obtain a long-term loan, which must be paid back through monthly mortgage payments. These payments have several components to them, which means that the amount you pay each month may be somewhat higher than you expected. Before you apply for a mortgage loan, make sure that you fully understand what goes into the payments you’ll be making each month.

How to Figure Out Monthly Mortgage Payments

Principal and Interest Components

The principal of the loan refers specifically to the exact amount of money you borrowed to purchase the home. If the home cost $200,000, your principal will be $200,000 as well. In the first years of the loan, the payments that you make will be focused more heavily on paying interest. However, the latter years of the loan will apply more to the principal. The interest that you pay is derived from the interest rate that you accepted when obtaining a mortgage loan. This rate is designed to lessen the lender’s risk of providing you with a loan. On a 30-year fixed-rate mortgage, the brunt of your monthly payments will be interest. Make sure that you get in touch with the best Las Vegas mortgage brokers so that you can find a low interest rate. (Read on how to get ideal interest rates on your mortgage.)

Taxes You’ll Need to Pay

A small amount of the monthly mortgage payment will be centered around any property or real estate taxes that you’re required to pay. These taxes can change every year and are calculated by the government. These payments are collected by the lender and held within an escrow account until the time at which taxes must be paid.

Potential Insurance Requirements

Every homeowner must purchase property insurance to protect the home from fires and theft. If your down payment on the home is less than 20 percent, you will be required to purchase private mortgage insurance as well. If you’re unable to repay your loan, PMI insurance provides protection to the lender. These payments are also held in escrow until the money is due.