Current Interest Rates For Mortgages

The global COVID-19 pandemic has dramatically impacted the real estate market. One benefit of the pandemic is that interest rates are very low following inventory shortages and rising prices. Currently, the interest rate on a 30-year home loan is roughly 3.24%, which is nearly a percentage point lower than at the same time in 2019. As a mortgage lender will explain, experts share their predictions on how the COVID-19 pandemic may influence buyers’ preferences and the housing market in the short-term and over a longer period of time.

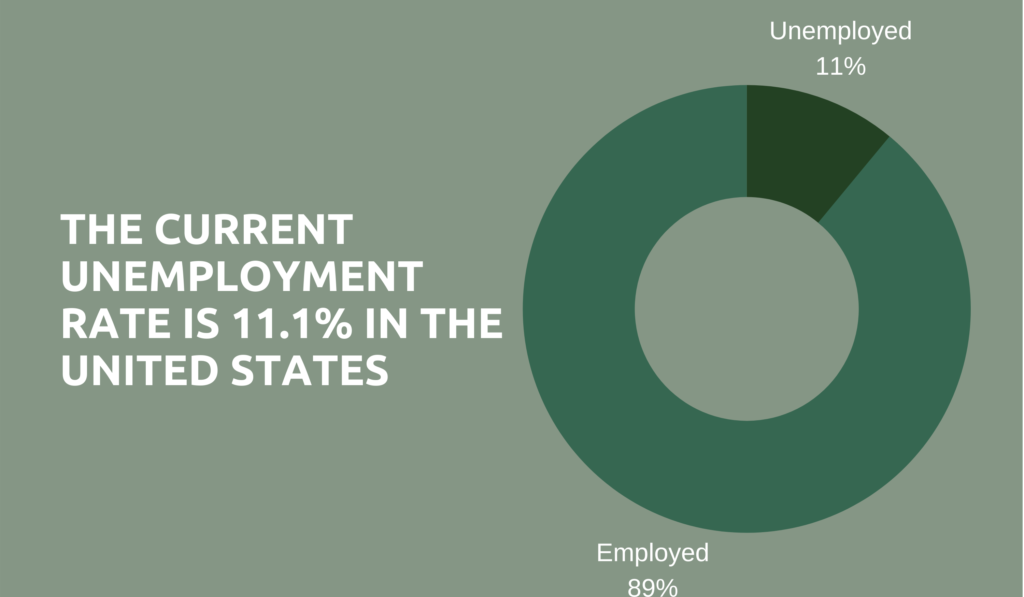

Qualifying Challenges

Experts say that homeownership may become more challenging for Americans in the wake of the COVID-19 pandemic as employers are cutting back on pay. Smaller paychecks translate to heightened risks for lenders, making it more challenging to qualify for a mortgage in Las Vegas. While homeownership might be less feasible for many Americans at this time due to more stringent qualifying standards, renting is an appealing option for many, even as a temporary alternative to homeownership. At the same time, the job market and economy continue to improve.

Sizing Up

Prior to the COVID-19 pandemic, Americans were typically inclined to scale down and purchase smaller homes, as they spent less time at home and more time out in cafes, bars, restaurants, and other places. Now, however, people are spending more time in their homes and finding that their homes have less space than is ideal. If that situation sounds familiar, you may want to contact a mortgage company Las Vegas to inquire about getting a mortgage for a larger home. If you were already considering buying a home, you might want to explore the options for sizing up, too, especially if you have a growing family or think you will need more room for expansion down the road.

Now’s the Time to Buy

While the economic impact may deter some buyers in the wake of the COVID-19 pandemic, it may also create an incentive for others to make a home purchase. Interest rates may drop below 3% by the end of 2020, according to some sources. As a result, you can find a mortgage lender in the Las Vegas area offering rates as low as 2.5% for purchase mortgages. These historically low rates are appealing for many people, especially first-time home buyers.

Buying a Second Home

Because of lower interest rates, buying a second home is more appealing now for many people who were previously on the fence about whether or not to purchase an additional home. However, even though interest rates may be lower, be aware that mortgage rates for second homes typically cost more than mortgage rates for new homes. Additionally, there are other expenses to be aware of, such as homeowners’ insurance, maintenance costs, and additional property taxes. Furthermore, demand for second homes is generally correlated to stock market performance, which can work in favor of or against prospective homeowners who choose to purchase a second home following the pandemic. (Read about the home buying guide for veterans here.)

Technological Transactions

When social distancing protocols remain in place, people rely more on virtual visits and technology. That can be a problem for some prospective buyers, as it doesn’t allow them to truly experience the neighborhood and its surroundings. Before committing to a purchase, home buyers want to see all the pros and cons of their prospective new home, including the immediate next-door neighbors, the area’s walkability and safety, traffic noise, and other features that can typically only be experienced through an in-person visit.

Virtual Visits

One advantage of real estate market transactions becoming more virtual is that the paperwork burden is expected to be reduced for buyers. The paperwork process has moved to a more virtual one over the past several years, and that trend is likely to continue among real estate brokers and mortgage companies who want to keep clients happy and eager to purchase homes in the wake of the COVID-19 pandemic. Along with the paperwork, the real estate marketing process is expected to become more virtual, making it easy for prospective homeowners to get a quick sneak peek.

The COVID-19 pandemic has created many changes for mortgage rates and the real estate market, and that trend is expected to continue. A mortgage company in Las Vegas can explain the pros and cons of the current housing market and tell you what to expect. Contact us for assistance and expert advice today.