Home Buyers Guide

What to Know Before You Buy Your First Home

If you’re thinking of buying a home, now is the perfect time to take the plunge. While you may be nervous about purchasing a house, don’t worry, as the pros at Drennen Home Loans are here to help. From learning more about mortgages and loans in Las Vegas to shopping for a home and making a down payment, you’re in good hands with Drennen as you prepare for one of life’s major milestones.

The prospect of buying a home is exciting, but there are also some things to keep in mind before you jump into your purchase. That is especially true for first-time home buyers. Even if you are just starting to look for homes in the area, you’ll want to contact a mortgage company in Las Vegas to ensure that you have assistance with every step in the process.

Are You Ready to Buy?

Buying a dream home is something you’ll enjoy for a long time. To make sure you don’t go outside of your financial comfort zone, you will want to ask yourself three main questions before you decide to buy a house. For starters, you’ll want to make sure that you have a steady job and a reliable source of income. Having a good credit score is also important, although it is possible to work on improving your credit score while you’re going through the process of purchasing a home. You probably already know that making a decent down payment on your home is essential. However, you should also have more money to spend on a home beyond the amount that you spend on the initial down payment. If you can check off the items listed above, you may be ready to take the next step forward in home ownership. If you need assistance determining which loans in Las Vegas you qualify for, loan officers can help you.

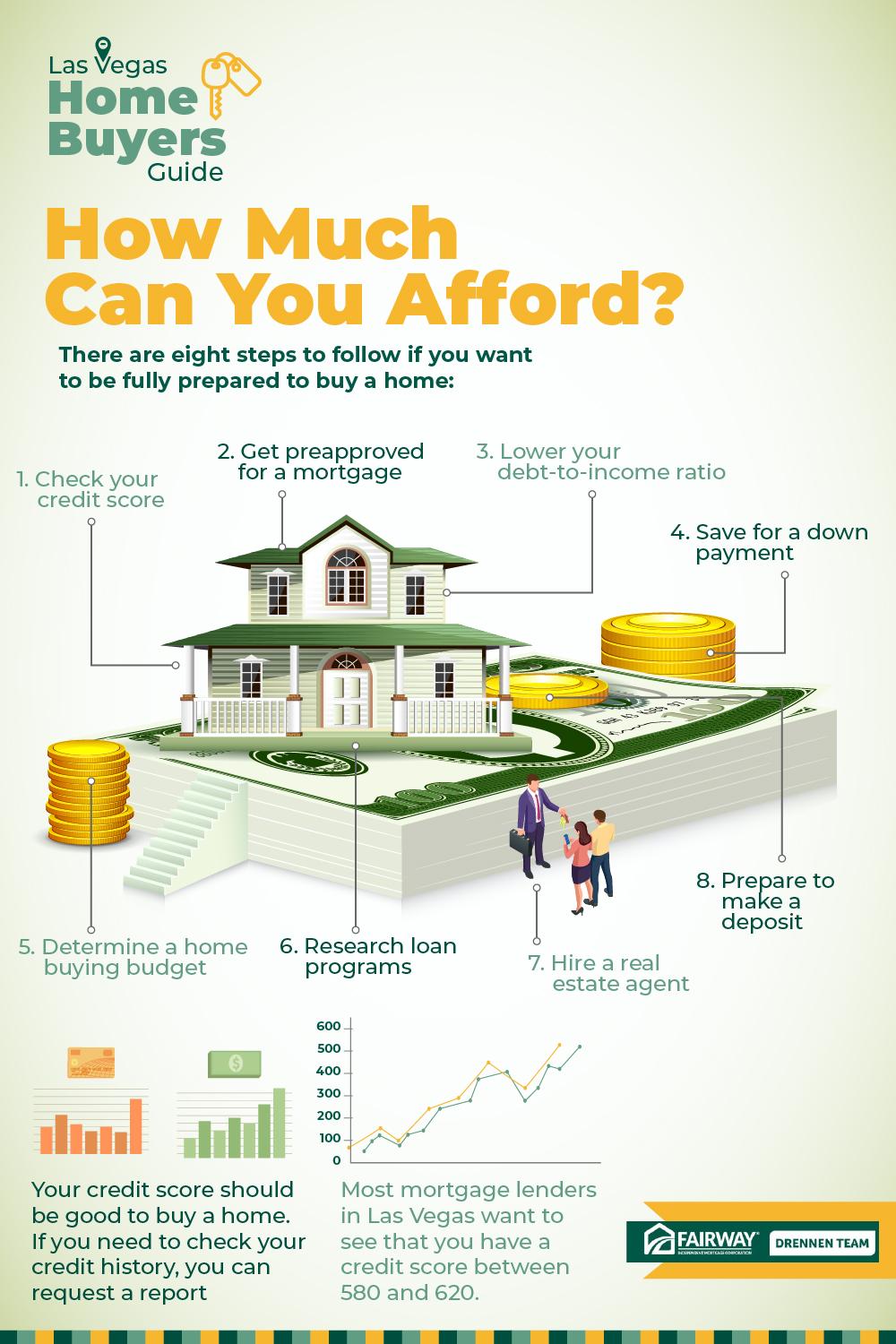

How Much Can You Afford?

There are eight steps to follow if you want to be fully prepared to buy a home:

- Check your credit score

- Get preapproved for a mortgage

- Lower your debt-to-income ratio

- Save for a down payment

- Determine a home buying budget

- Research loan programs

- Hire a real estate agent

- Prepare to make a deposit

Your credit score should be good to buy a home. If you need to check your credit history, you can request a report from one or all three of the major credit bureaus, which include TransUnion, Experian, and Equifax. Most mortgage lenders in Las Vegas want to see that you have a credit score between 580 and 620. If your credit score is lower, you’ll want to leave yourself time to fix it. Therefore, you should request your credit score about 6-12 months in advance. Requesting your credit score at least half a year before you buy a home also gives you a chance to make sure there aren’t any errors on your credit reports and fix any existing problems.

If you are thinking about Las Vegas mortgage rates when you are considering buying a new home, you are already showing that you can be a responsible homeowner. Mortgage rates vary with the type of loan that you get and its duration. If you get preapproved for your mortgages, the lender will agree to fund your home, assuming it appraises in value. If you get preapproved for your mortgage, you will know exactly how much mortgage you can afford to carry, as the lender will take into consideration factors like your debts, credit score, and income. You can get the approximate purchase price once you add up those numbers.

What is the down payment on a home loan in Las Vegas?

Mortgage lenders use your debt-to-income (DTI) ratio in Las Vegas to see how much of a down payment you can afford to make. The DTI shows how much of your gross income each month goes towards debt repayment. Generally, mortgage brokers in Las Vegas prefer a DTI of 36% to 43%. This number may vary slightly depending on the mortgage program you decide to use. For example, if you have a monthly income of $4,000, your DTI will be 43%, and your monthly debt payments will be about $1,720. If you have a DTI that’s on the higher side, you don’t necessarily have to worry. Some mortgage lenders are okay with allowing a higher DTI ratio, but that is only if a borrower has other factors like significant cash reserves or a high credit score that can make up for having a high DTI. If you feel your DTI is higher than you’d like, you can pay off debt before applying for a mortgage. That includes reducing your student loans, auto loans, credit cards, and any other outstanding loan that you may have. You don’t have to be totally free of debt to buy a home. However, lowering the debt that you do have will improve your purchasing power.

Buying a house is a major financial investment, much like purchasing a car or any other significant expense. To make home ownership more feasible, mortgage lenders in Las Vegas recommend starting to save as early as possible for a down payment. Most home loans in Las Vegas, namely conventional loans, require homeowners to put down at least 5% on their down payment. You may be able to put down as little as 3% with a conventional loan, and with a federal housing authority (FHA) loan, you can put down as little as 3.5%. To put percentages into numbers, if the home you want costs $300,000, you will need to spend somewhere between $9,000 and $15,000 for your down payment. Keep in mind that you will also need to pay for the closing costs, which can range from 2% to 5% of the total of your loans in Las Vegas, or between $4,000 and $10,000 if you have a $200,000 loan.

However, some home loans are also available to qualifying individuals for lower down payment amounts. If you pay less than the standard amount on your down payment, you will likely need to pay mortgage insurance each month. When you apply for a mortgage loan, mortgage lenders in Las Vegas will ask you to provide bank statements to make sure that you qualify for home loans in Las Vegas. If you don’t have adequate amounts of cash, some mortgage brokers in Las Vegas will let you use gift funds to cover the cost of your mortgage-related expenses. Every state also has a down payment assistance program (DPA) that allocates loans or grants to qualified home buyers who need assistance with their down payments.

Determining how much you can afford to spend on a home is critical. Before you meet with mortgage lenders in Las Vegas, you can use an online calculator to get an estimate of the amount you can afford to spend on a home. Once you know the range of home prices you can afford, you can figure out how much you will need to save for predictable expenses such as the down payment and closing. Keep in mind that mortgage calculators vary. Some give you an estimate of your monthly payment based on the price of your home, along with related expenses such as the down payment, loan terms, interest rate, and monthly mortgage expenses. Property taxes, homeowner’s insurance, and homeowners association (HSA) fees may all be added to the equation as well.

If you are worried about the cost of buying a home, consider looking into a loan program for assistance. A lender can tell you about the kinds of mortgages available for home loans to purchase your home. However, before you meet with the lender, you may want to research on your own to figure out what loan program and type may work best for you. It’s important to shop around for loans rather than settle for the first loan program that you see, as you may be missing out on better rates. When searching for a loan, think about the things that you want in your mortgage. That may include the lowest down payment and monthly mortgage payment, steering clear of private mortgage insurance, and paying off your loan as quickly as possible. Speaking with a loan officer can help you more easily find a good match for home loans when you have a better idea of what you want. Ultimately, knowledge is the best tool if you want to find the best loan for your circumstances.

Working with a real estate agent can help you determine what kind of home you want and how much you want to spend on your house. A local real estate agent will be knowledgeable about the homes available for sale in the area, along with the nuances of the local market. Working with a real estate agent is also an excellent way to learn more about the area if you are moving from someplace else. There are many neighborhoods in Las Vegas alone, for instance, that a real estate agent can help you understand. Knowing about the slight variations among the different places may help guide you in your decision about buying a home.

Once you find a home you want to buy, closing on the home can be reasonably quick. That’s especially true in a competitive market like Las Vegas. When you decide that you want to purchase a home, the current owner will want some assurance that you are serious about buying the house. For peace of mind, a deposit is usually recommended or even required for people who want to purchase a home. The deposit amount may vary, and you may be able to negotiate with the homeowner about how much you initially put down to hold your spot as a new homeowner. A deposit on a new home is called an earnest money deposit. The average deposit amount is 1%-2%, which amounts to a price around $500 – $1,000. The seller usually puts the money in an escrow account, and it is generally either returned to the buyer at the time of closing or applied to either the closing cost or the down payment.

Timing is Everything

There’s a popular saying that timing is everything, and that applies to buying a home, too. Prospective home buyers do not think about timing when they buy a home. One thing to think about is whether you want to rent a house or buy one. While some people jump to buying a home, renting a place may have benefits that you might not initially think about. For instance, mowing the lawn, gardening, painting your house, and other general chores can take time out of your busy schedule. While spending time on chores may seem like a minor issue for new homeowners, it’s something to think about if you like to save the weekend for fun activities that you do not generally get to do during the week.

Compile a Buying Team

It’s hard to take on the task of buying a home solo. For that reason, many people are putting together buying teams this year to help them buy their dream homes. Your buying team may consist of a knowledgeable real estate agent, a mortgage lender, a buyer agent, and a professional home inspector. The professionals you hire to help you buy a home will work with each other and with you to ensure that you can complete your home purchase as quickly and as smoothly as possible. Although you can generally count on your professional team to help you make the most of homeownership, keep in mind that many residential markets will tip towards sellers in the near future. That means you’ll need to be smart about finding a home you want to live in and acting quickly to make homeownership a reality rather than just a dream.

Interest Rates

Las Vegas mortgage rates are often overlooked when people set out to buy a new home, but they are critical to consider. This year, many prospective homeowners are wondering if mortgage rates are rising, if they’re staying the same, or even if they are falling. So far this year, and experts think this trend will continue, mortgage rates will likely continue rising for the rest of the year. Mortgage rates are affected by several factors, including inflation, global events, bond prices, the Federal Reserve, and the personal circumstances of homebuyers. Inflation and mortgage rates are usually inseparable. If one increases, the other usually does as well. If inflation falls, on the other hand, mortgage rates generally drop. World events like the COVID-19 pandemic have also affected interest rates in the past two years. The Federal Reserve also impacts interest rates by raising or lowering rates based on the need to control the nation’s money supply. The Fed raises interest rates if they need to tighten the money supply. When bond prices rise, mortgage rates usually drop, and vice versa. Las Vegas mortgage rates through bonds can also rise or fall based on demand. At the start of 2022, interest rates were 3.22% for a 30-year mortgage and 2.43% for a 15-year mortgage.

Las Vegas mortgage rates are often overlooked when people set out to buy a new home, but they are critical to consider. This year, many prospective homeowners are wondering if mortgage rates are rising, if they’re staying the same, or even if they are falling. So far this year, and experts think this trend will continue, mortgage rates will likely continue rising for the rest of the year. Mortgage rates are affected by several factors, including inflation, global events, bond prices, the Federal Reserve, and the personal circumstances of homebuyers. Inflation and mortgage rates are usually inseparable. If one increases, the other usually does as well. If inflation falls, on the other hand, mortgage rates generally drop. World events like the COVID-19 pandemic have also affected interest rates in the past two years. The Federal Reserve also impacts interest rates by raising or lowering rates based on the need to control the nation’s money supply. The Fed raises interest rates if they need to tighten the money supply. When bond prices rise, mortgage rates usually drop, and vice versa. Las Vegas mortgage rates through bonds can also rise or fall based on demand. At the start of 2022, interest rates were 3.22% for a 30-year mortgage and 2.43% for a 15-year mortgage.

Get a Home Inspection

Although it might seem like just one more step you must take before you purchase a home, scheduling a home inspection can make a big difference in the outcome of your home purchase. A home inspection should be arranged with a professional before closing. A professional can detect any problems that you might not see with your untrained eye. If there are any significant issues with the home, a professional can spot those problems and notify you before you go through with your home sale. That gives you tremendous power for negotiating the price of the home if you want the current owner to cover the cost of the repairs. If the problem is significant and would cost a fortune to repair, you can also back out of the home sale before it’s too late. It is best to contact a professional for a home inspection during the buying process.

Are You Ready to Buy a Home?

Many people gravitate to homeownership because they think they will save money if they buy a home rather than rent one. That’s especially true if rents are higher in the place where you are living. However, even if you qualify for mortgages in Las Vegas with reasonable interest rates, you may not enjoy major cost savings by buying a home in the long run. If nothing ever happens with your home, you may save money monthly on maintenance and repairs. However, the likelihood of that happening is relatively low. If you own your own home, you are responsible for all the maintenance and upkeep that comes along with it, including fixing up the water heater, appliances, leaking roof and faucets, landscaping, exterior maintenance, and more. The cost of keeping up with all these repairs can easily exceed the cost of your monthly rent, which means that renting a place ends up being more affordable.

If you think you are ready to purchase a home in 2022, contact a mortgage lender for guidance and assistance in navigating the homeownership process.